MVRV Ratio

MVRV (Market Value to Realized Value) ratio is defined as an asset's market capitalization divided by realized capitalization.

Definition

MVRV (Market Value to Realized Value) ratio is defined as an asset's market capitalization divided by realized capitalization.

Market Value to Realized Value (MVRV) Overview

The Market Value to Realized Value (MVRV) ratio serves as a crucial metric in the world of cryptocurrency, offering valuable insights into market dynamics and investor behavior. Understanding how MVRV is measured and its implications can provide a nuanced perspective on the valuation of a cryptocurrency. Here's a comprehensive overview of the MVRV ratio:

Measuring MVRV

MVRV is calculated by comparing two key metrics: market capitalization and realized capitalization. Market capitalization is determined by multiplying the current market price of a cryptocurrency by its circulating supply. On the other hand, realized capitalization considers the aggregate value of all coins based on the price at which they were last transacted.

Interpretation

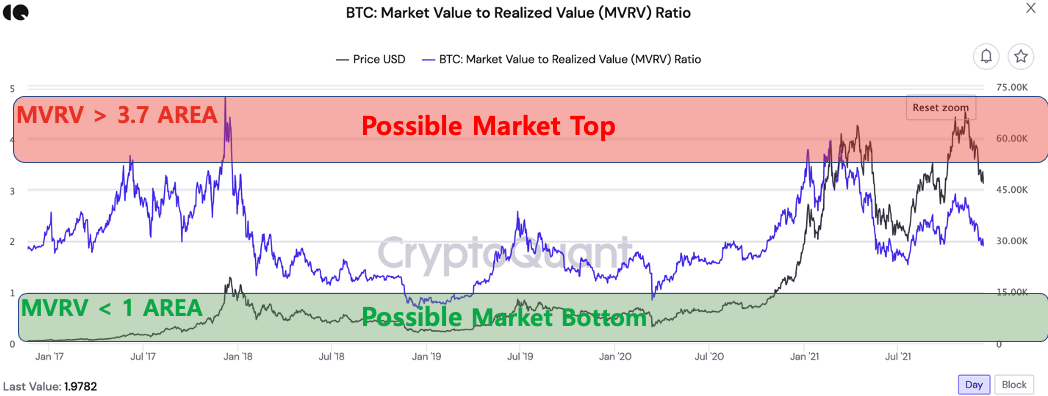

By comparing two valuation methods, the MVRV ratio can tell us to get a sense of whether the price is fair or not, which means it is useful to get market tops and bottoms.

It is important to note that historically, it has been an outstanding indicator to spot market top/bottom or local top/bottom that occurred through three halvings.

By Value Itself

MVRV accounts both realized cap and market cap into account making certain values critical in making an investment decision.

Values over ‘3.7’: Possible Market Top

If the values go above 3.7, it could be reasonable to sell the position off

Values under ‘1’: Possible Market Bottom

If the values go under 1, it is time for taking a gradual long position.

By Examining Trend

If Market cap growth outpaces that of the realized cap, MVRV values rise indicating possible motive for selling.

Increasing trend: Increasing selling pressure

As MVRV increases, it indicates that the market cap is outpacing realized cap meaning there is increasing motive for selling in the market.

Decreasing trend: Decreasing selling pressure

As MVRV decreases, it indicates that realized cap is outpacing the market cap meaning there is decreasing motive for selling in the market.

Implications of MVRV

Overvaluation and Market Tops

High MVRV: When MVRV values are elevated, it may signal that the current market price of Bitcoin is significantly higher than the last transaction prices. This could indicate a state of overvaluation, potentially signaling a market top. Analyzing Bitcoin's fair value in the context of MVRV provides essential insights into whether the current price aligns with the aggregate market cost basis.

Undervaluation and Market Bottoms

Low MVRV: Conversely, a low MVRV suggests that the current price of Bitcoin is relatively lower compared to the last transaction prices. This could point towards undervaluation, potentially signaling a market bottom. Investors keen on assessing the average price of Bitcoin in relation to its MVRV can use this metric to gauge potential buying opportunities.

Market Sentiment and Investor Behavior

Fluctuations in MVRV: Monitoring changes in the MVRV ratio over time provides insights into shifts in market sentiment and investor behavior, influencing Bitcoin's current market value. Sudden spikes or dips can indicate changing perceptions about the Bitcoin price, offering traders valuable information for strategic decision-making.

Long-Term vs. Short-Term Holder Behavior

Divergence in MVRV: Analyzing the MVRV for short-term holders versus long-term holders can reveal variations in behavior. A significant divergence might suggest different outlooks and strategies between these two groups of Bitcoin investors, shedding light on potential market trends.

Risk Management

MVRV Trends: Traders and investors can use Bitcoin MVRV trends to inform their risk management strategies. Understanding whether Bitcoin is currently trading at a premium or discount relative to its realized value can aid in making more informed decisions about the current Bitcoin price. This nuanced approach is crucial for navigating the dynamic and ever-evolving Bitcoin landscape.

End Notes

The MVRV ratio serves as a valuable tool for assessing the relative valuation of a cryptocurrency, offering a nuanced perspective on market conditions and investor sentiment. Traders and investors can leverage this metric to make more informed decisions in the dynamic and ever-evolving cryptocurrency landscape.

Link to Our Data

Was this helpful?