Exchange In/Outflow and Netflow

Exchange inflow is defined as the amount of coins deposited into exchange wallets. Exchange outflow is the amount withdrawn from exchange wallets. Exchange Inflow - Outflow = Netflow.

Definition

Exchange Inflow is defined as the amount of coins deposited into the crypto exchange wallets.

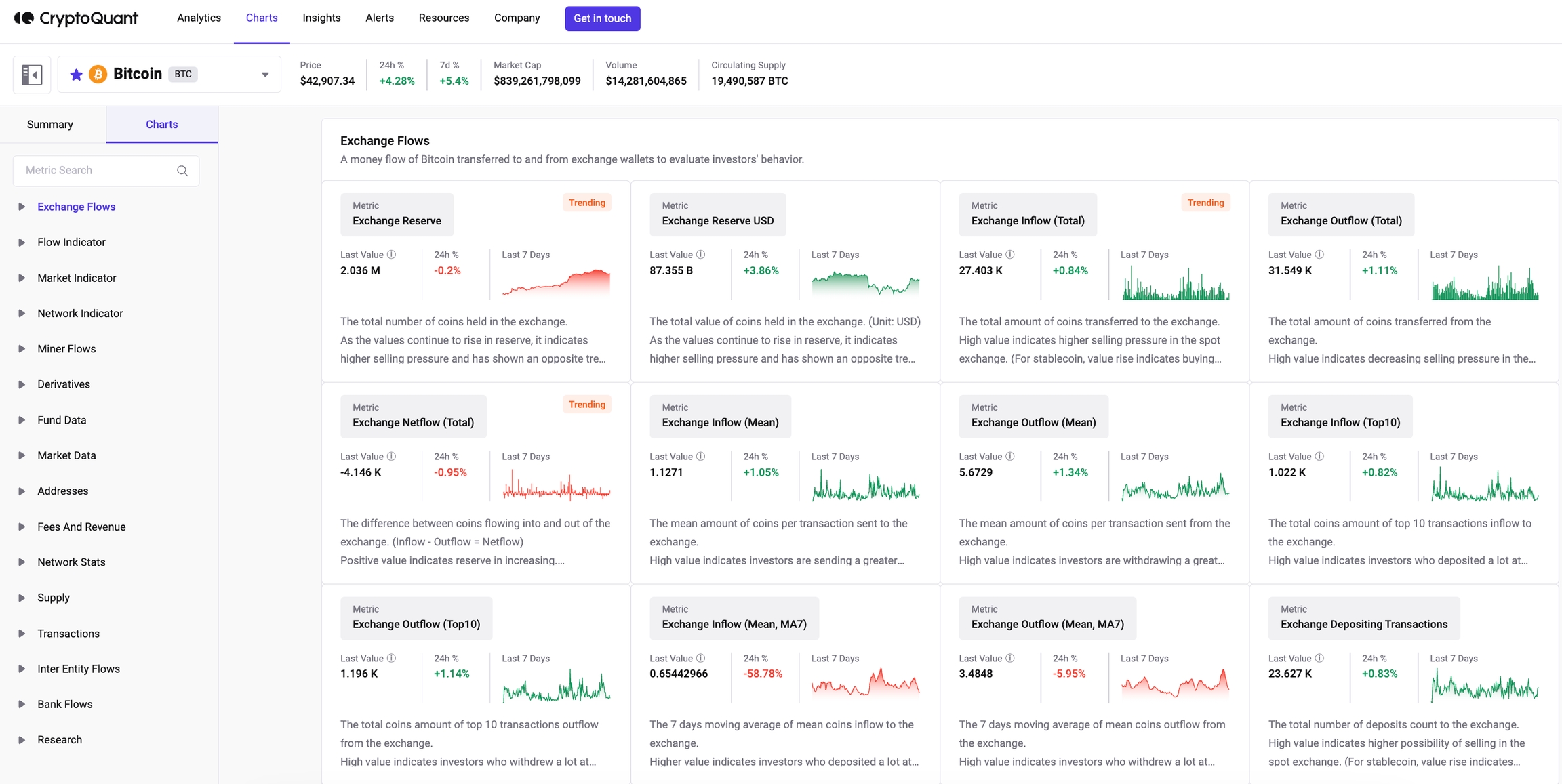

Metrics

Description

Inflow Total

The total amount of BTC transferred to the exchange.

Inflow Mean

The mean amount of BTC per transaction sent to the exchange.

Inflow Top10

The total BTC amount of the top 10 transactions inflow to the exchange.

Inflow Mean(MA7)

The 7 days moving average of mean BTC inflow to the exchange.

Exchange Outflow is defined as an amount of coin withdrawal from the exchange wallets.

Metrics

Description

Outflow Total

The total amount of BTC transferred from the exchange.

Outflow Mean

The mean amount of BTC per transaction sent from the exchange.

Outflow Top10

The total BTC amount of the top 10 transactions outflow from the exchange.

Outflow Mean(MA7)

The 7 days moving average of mean BTC outflow from the exchange.

Exchange Netflow is the difference between BTC flowing into and out of the exchange. (Inflow - Outflow = Netflow).

The mean value is the In/Outflow Total divided by the Transactions Count In/Outflow.

Interpretation

By Value Itself

The increase in inflows to exchanges is mostly a Bearish sign.

The increase in outflows from exchanges is mostly a Bullish sign.

By Examining Trend

Increasing inflow/outflow indicates possible volatility and helps predict market trends.

Explanation

About Inflows

Considering the fact that moving coins costs fees, wallets from outside exchanges send their coins to crypto exchanges for three possible reasons.

1) To Sell their Coins - Bearish

In the case of inflow to spot exchange, investors are likely sending Bitcoin (BTC) for selling. This action includes retail buyers' coins moving into the exchange but also the result of custody services provided by institutional buyers. Instead of storing them in cold storage, they move them into other services, such as exchange wallets. This indicates the urge to turn coins into fiat assets or stablecoins.

This reason of action mostly leads to the price drop which indicates a bearish sign.

2) To Trade in the Derivative Market - Volatility Risk

The purpose for sending coins to derivative market wallets indicates that more trades will be happening on the derivative market. This could possibly lead to increased volatility risk as a result of increased trading activity, investors looking to take profits, and/or to rebalance to de-risk their investment portfolios. This type of action has difficulty in deciding the effect on price since coins in the derivative market could be used to open both long/short positions.

Instead, it should be interpreted as increased volatility risk.

3) To Use services in Crypto Exchanges - Neutral

Sometimes, investors send their coins to exchange for the purposes of staking, airdrop, and to fit the requirement for IEO. In this case, there is no indication to infer on both price or volatility. However, please note that in the case of an airdrop, indicators such as funding rate and open interest should be considered due to price hedge motivation.

This reason of action should be interpreted as neutral.

About Outflow

Considering the fact that moving coins cost fees, Bitcoin wallets outside from exchanges send their coins from the exchanges for two possible scenarios.

1) Moving coins after the purchase- Bullish

In the case of outflow from the spot exchange, these metrics show that investors are likely sending BTC outside for storage. Instead of letting their coins sit in the exchange wallets, investors are pulling out their coins from exchange to hold their coins for security and long-term hold. This action includes retail buyers and holders' coins moving out of the exchange but also the result of custody services provided by institutional buyers.

This reason of action mostly leads to the price rise which indicates a bullish sign.

2) Moving coins that are no longer needed for derivative trades

The purpose for sending coins from derivative market wallets indicates that fewer trades will be happening on the derivative market. This could be the result of trading activity where investors take profits or rebalance to de-risk their investment portfolios.

Inflow vs. Outflow

When Bitcoin/liquidity inflows into exchanges, these metrics often signal an intent to sell or engage in dynamic trading activities. Conversely, when coins make their way out of exchange wallets, it signifies a more optimistic outlook. Investors withdrawing coins are essentially expressing confidence in Bitcoin's long-term potential, akin to holding onto prized assets. This nuanced understanding of inflows and outflows provides a valuable compass for interpreting investor sentiment.

By Examining Trend in Values

Indicating the Level of Exchange Activity

A positive trend of inflows or outflow to centralized exchanges can indicate an increase in overall exchange activity, meaning more and more users actively use the exchange for trading. This possibly means that the sentiment of traders is in the bullish moment. According to this interpretation, the other way around means bearish sentiment.

Predicting Volatility

Bitcoin In/Outflow Mean(MA7) explain the strength of previous volatility in price, which possibly means the current position might be local tops or bottoms. This is because a portion of large inflows is based on transactions among exchanges, where the analysis is done by the CryptoQuant research team, and this phenomenon can be explained by the results of arbitrage strategies.

Predicting Market Trend (Bullish or Bearish)

Based on the "Exchange Activity" interpretation, we can see the trend of inflow to all exchanges and outflow of liquidity from all exchanges by applying a moving average to data, which is one of the well-known technical indicators for having data's historical trend. We also apply multiple moving averages to see exact inflection points, called moving average ribbon.

As you can see below, both inflow and outflow trends roughly well-explain bullish or bearish sentiments for the past 3 years where a stable and meaningful number of exchanges have been activated, which supports the "Exchange Activity" interpretation.

Predicting Volatility with Bticoin (BTC) Inflow/Outflow Mean(MA7)

By looking at Bitcoin (BTC) Inflow Mean (MA7)'s degree of where local tops are located, we can estimate how much the current location is a local top (in red circle) or bottom (in green circle). If your BTC Inflow Mean (MA7) value is in a similar position, you need to check other complementary indicators telling you selling or buying pressure to determine the current price position is in the local top or bottom.

By looking at Bitcoin Outflow Mean's (MA7's) degree of where local tops are located, we can estimate how much the current location is a local top (in red circle) or bottom (in green circle). If your BTC Outflow Mean (MA7) value is in a similar position, you need to check other complementary indicators telling you selling or buying pressure to determine the current price position is in the local top or bottom.

Link to Our Data

Last updated

Was this helpful?