Exchange Reserve

The total amount of coins held in the exchange addresses.

Definition

Exchange Reserve refers to the overall quantity of coins or cryptocurrencies, like Bitcoin, stored in the wallets or addresses controlled by a particular exchange. It represents the total holdings that the exchange has available for various purposes, such as facilitating trades, withdrawals, and managing user balances.

Interpretation

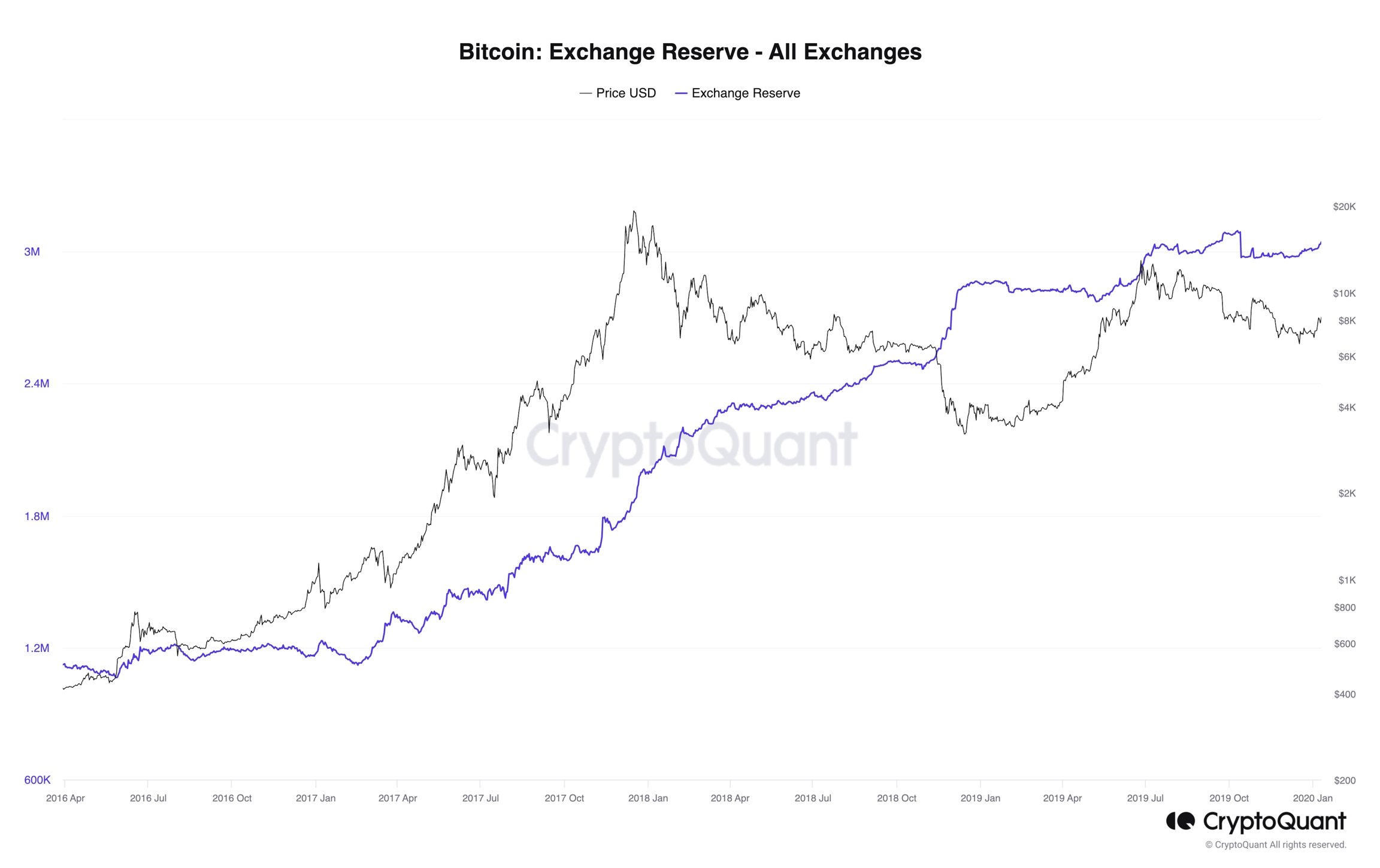

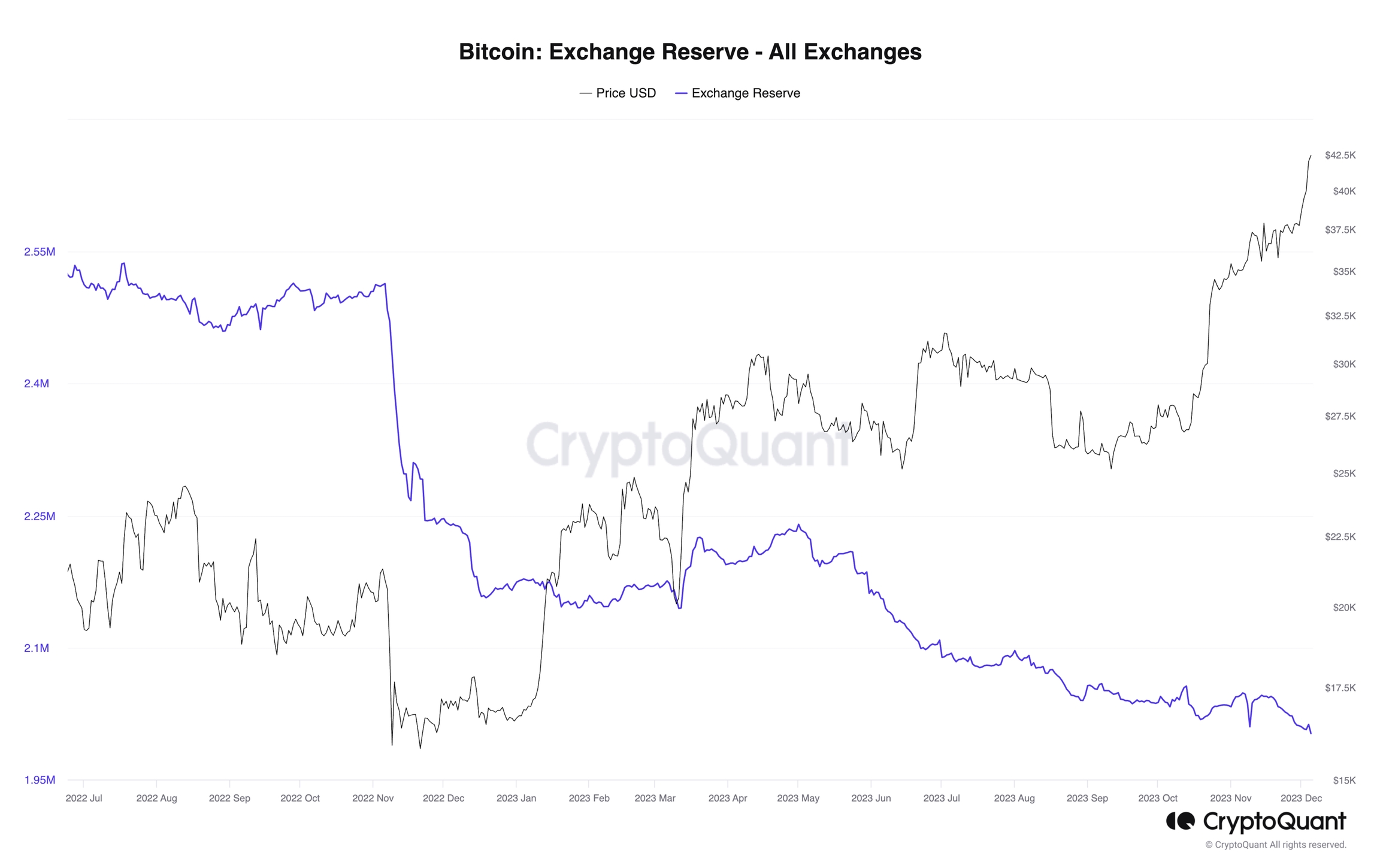

Understanding the dynamics of exchange reserves involves recognizing its role as a key metric in determining the availability of coins for potential sale within the market. The exchange reserves serve as an aggregated measure, reflecting the total quantity of coins held by the exchange and poised for potential transactions.

Exchange Reserve is the accumulated result of Exchange In/Outflow & Netflow which naturally follows the indications that in/outflow has. Similar to Exchange NetFlow's interpretation, an increasing trend in netflow indicates the selling pressure and the decreasing trend indicates the buying pressure.

Much like the interpretation of Exchange NetFlow, which tracks the net movement of assets into or out of an exchange, Exchange Reserves provides insights into market dynamics. An upward trend in the exchange reserves typically suggests an increasing selling pressure, indicating that more coins from the exchange's holdings are potentially entering the market for sale. Conversely, a downward trend in the exchange reserves points towards decreasing selling pressure, implying that fewer coins are available for sale.

In essence, the interpretation of the exchange reserves, coupled with insights from related metrics like Exchange NetFlow, aids analysts and market participants in gauging the overall sentiment and potential market direction of currencies based on the exchange's coin holdings and their movement patterns.

However, instead of Exchange In/Outflow & Netflow indicating the specific moment or period, Exchange Reserves makes it easy to track the result of the entire period's movements.

By Value Itself

The exchange reserve is a valuable metric that provides insights into the level of accumulated selling pressure within an exchange. By analyzing exchange reserves, market participants can gain a clearer understanding of the dynamics influencing the supply of coins available for trading.

High Selling Pressure

In scenarios where the exchange reserves are high, it signifies an elevated level of selling pressure in the market. This occurs when a substantial number of coins are held within the exchange's addresses, awaiting potential trades. Essentially, market participants are opting to keep a large portion of their holdings within the exchange, suggesting a readiness to sell. The increased exchange reserve serves as an indicator that a significant volume of coins is available for trading, potentially leading to a higher supply in the market.

Example

If a cryptocurrency exchange reports a substantial increase in its reserve, such as a spike from 10,000 to 50,000 Bitcoin over a short period, it implies to the markets that a considerable number of users have deposited coins into the exchange, signaling a heightened selling sentiment among traders.

Low Selling Pressure

Conversely, a low exchange reserve indicates diminished selling pressure. In such instances, a smaller number of coins are held within centralized exchanges, awaiting potential trade transactions. This suggests that market participants are more inclined to withdraw their coins from the exchange for purposes other than immediate selling, leading to a reduced supply available for trading.

Example

Suppose a cryptocurrency exchange experiences a decline in its reserve, dropping from 30,000 to 5,000 Bitcoin. This decline in reserve currency signifies to the markets that a smaller number of users are keeping their coins within the exchange, implying a lower selling sentiment and a potential shift towards other activities like becoming long-term holders or making external transfers.

By Examining Trend

Examining the trend of centralized exchanges and even decentralized exchange reserves is a pivotal aspect of financial analysis, providing insights into the dynamics of deposits, asset availability, and strategic practices of companies within the market. This examination is essential for risk management, assessing liabilities, and gauging potential profit in response to fluctuations in supply and demand.

Changing Status in Scarcity

Delving deeper into the changing status of scarcity, the trend in exchange reserves is a critical indicator for financial analysts. It involves the careful evaluation of deposits, the supply of assets, and the financial companies' practices to navigate through different economic regimes and countries.

Increasing Trend: Decreasing Scarcity - Bearish

Witnessing an increasing trend in exchange reserves often suggests a decrease in currency scarcity, a phenomenon that aligns with bearish market sentiment. In this scenario, financial companies may be opting to deposit more coins into the exchange, responding to a perceived decrease in risk and potentially lowering overall market power.

Example

A surge in exchange reserves from 20,000 to 50,000 Bitcoin during, for example, March, due to the spot Bitcoin ETF getting rejected, may be indicative of a strategic response to a decrease in perceived risk, a practice observed by many financial companies.

Decreasing Trend: Increasing Scarcity - Bullish

Conversely, a decreasing trend in exchange reserves signals an increasing scarcity of coins, an occurrence typically associated with bullish market movements. This trend signifies a preference for asset accumulation among market participants, reflecting a shift in supply-demand dynamics and a potential increase in market power.

Example

If exchange reserves decrease from 30,000 to 10,000 Bitcoin due to the spot Bitcoin ETF approval, it may suggest a bullish sentiment as financial companies and traders seek to accumulate assets, and become long-term holders amid decreasing Bitcoin scarcity.

Final Notes

In conclusion, the role of Bitcoin exchange reserves extends far beyond numerical values on a balance sheet. It serves as a compass, guiding investors through the ever-shifting landscape of cryptocurrency markets. By interpreting trends, understanding selling pressure, and analyzing changing scarcity dynamics, market participants can navigate strategic decisions with confidence. The insights drawn from exchange reserves not only shape investment strategies but also offer a glimpse into the collective sentiment of market participants. In a landscape marked by constant evolution, the scrutiny of exchange reserves emerges as a key practice for those seeking to master the art of strategic cryptocurrency investment.

Links to Our Data

Last updated

Was this helpful?