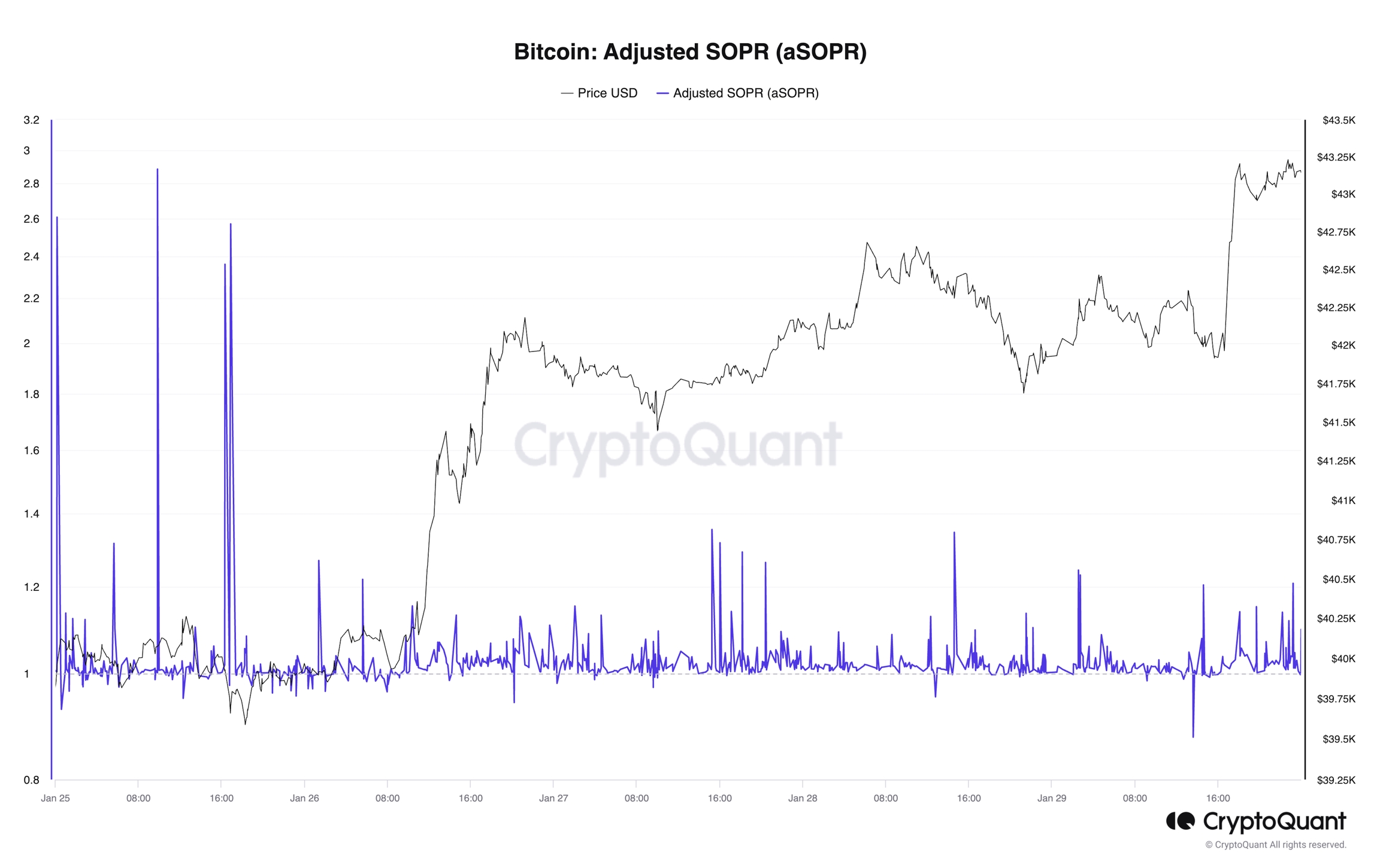

aSOPR (Adjusted SOPR)

Adjusted Spent Output Profit Ratio (aSOPR) is a ratio of spent outputs (lived more than an hour) in profit at the time of the window.

Definition

Interpretation

By Value Itself

By Examining Trend

Adjusted Spent Output Profit Ratio: Investing Applied Scenario

Last updated

Was this helpful?