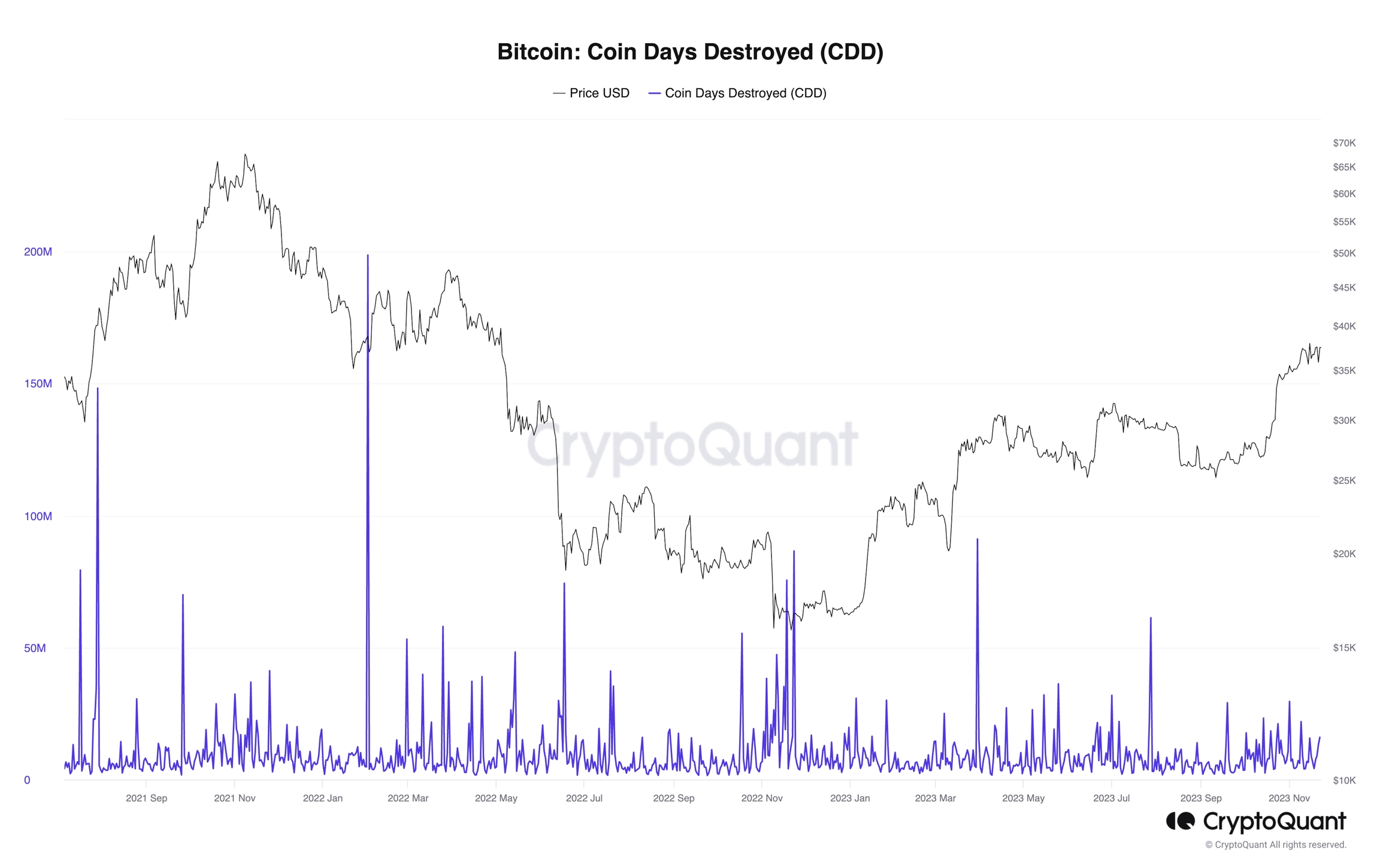

Coin Days Destroyed (CDD)

When UTxO is destroyed, Coin Days Destroyed (CDD) is calculated as the sum value of the number of days between created and spent multiplied by the UTxO amount.

Definition

Coin Days evaluates the number of coins that are not being spent, which gives more weight to estimate long-term-holder (LTH) position. When that coin is spent, the coin is considered "destroyed," and is being updated on Coin Days Destroyed (CDD) metric. CDD is the sum of products of spent transaction output alive days and its value.

Interpretation

By value itself

High: Long-held coins are moving in great amounts - Volatility Risk or Possible Trend Reversal

A large number of alive days are destroyed which indicates that long-term holders' coins are exposed to selling. Since coins held long have a huge impact on the market.

Low: Long-held coins are moving in less amount

By Examining Trend

Increasing trend: Increasing selling pressure

Long term holders' coins are continuously being sold

Decreasing trend: Decreasing selling pressure

Long term holders' coins are slowing down in movement

Note on Coin Days Destroyed

CDD gives more weight to:

1) Longer-lived UTXO

2) Amount of UTXO is holding BTC.

Weighting more on these makes the indicator sensitive to long-term holders' movement and shows sentiment & behavior.

Explanation on creation and destruction of UTxO(s)

For every coin that has not been spent on that day, it accumulates one "Coin Day." To understand the concept of "Coin Day" better, check the examples below.

A UTxO for 1 BTC that has not been spent for 10-days has accumulated 10 coin days.

A UTxO for 0.5 BTC that has not been spent for 100-days has accumulated 50 coin days.

A UTxO for 8 BTC that has not been spent for 6-hours (1/4 day) has accumulated 2 coin days.

When that coin is spent, the coin is considered "destroyed," and is being updated on CDD metric.

Coin Days Destroyed

An indicator, Coin Days Destroyed (CDD), offers insights into market participants who have held Bitcoin on-chain for an extended period.

What it measures: CDD metric is a measure of the cumulative number of days that a coin has not been moved before it is spent or transferred.

Why it matters: Indicates the "age" of a coin before it is used, helping to identify periods of significant coin movement.

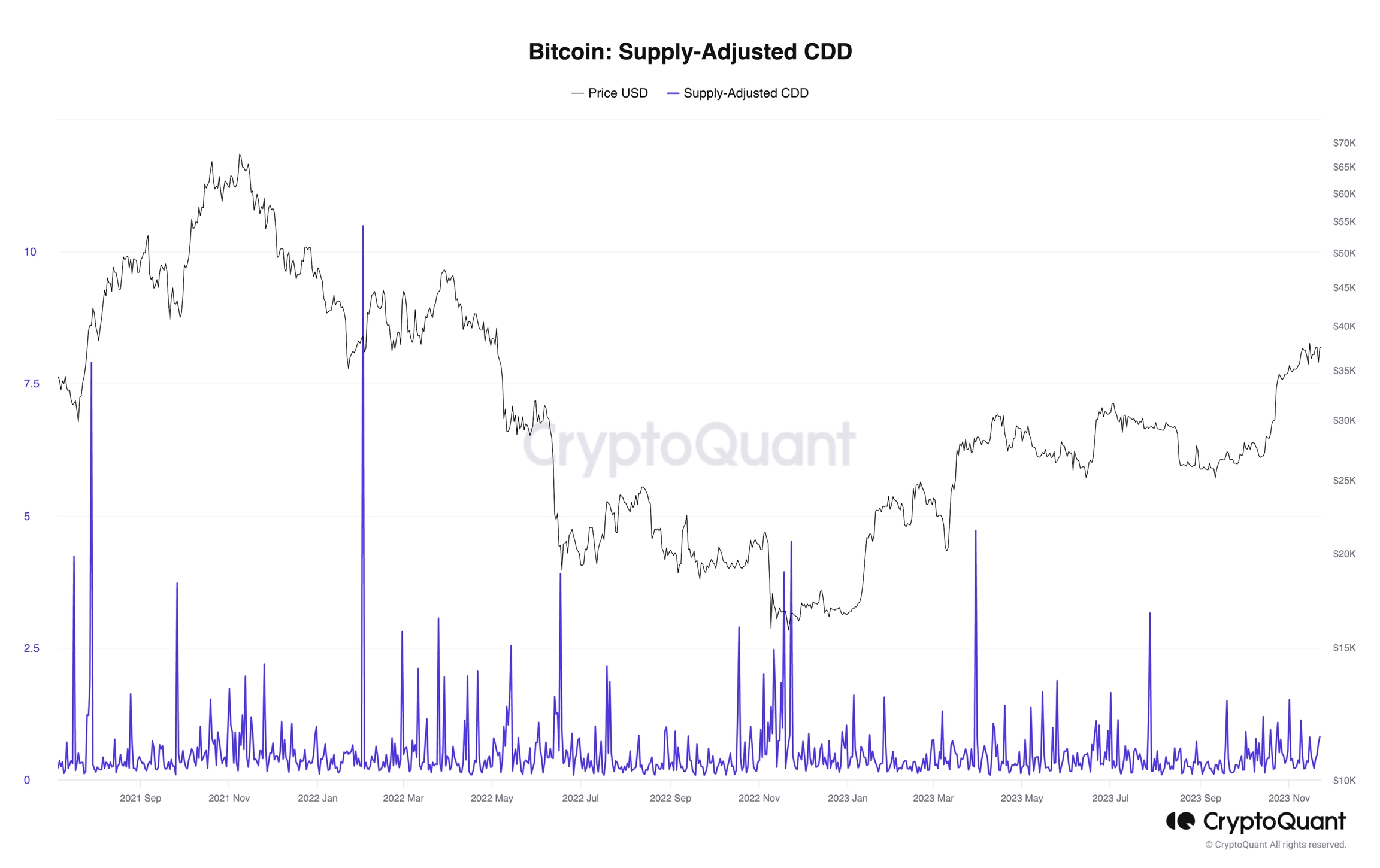

Supply Adjusted CDD

Normalized CDD by supply total.

What it measures: The amount of cryptocurrency (coins) moved or spent, adjusted based on the total supply.

Why it matters: Helps assess the significance of coin movements relative to the overall available supply.

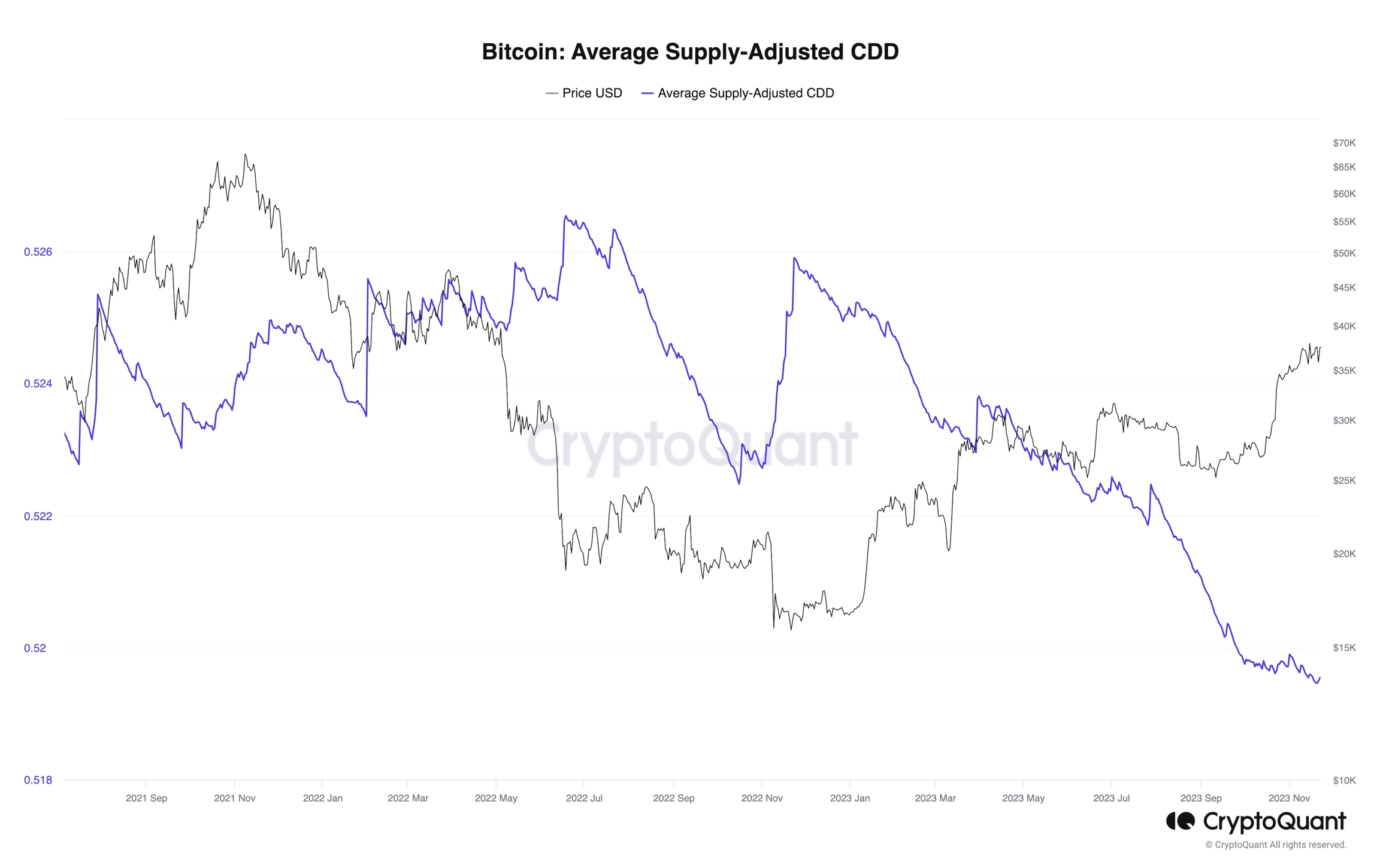

Average Supply Adjusted Coin Days Destroyed

Average value of Supply-Adjusted CDD since genesis block.

What it measures: The average age of coins destroyed in a transaction, adjusted for the total supply.

Why it matters: Gives insight into the average time coins are held before being spent or moved, considering the entire supply.

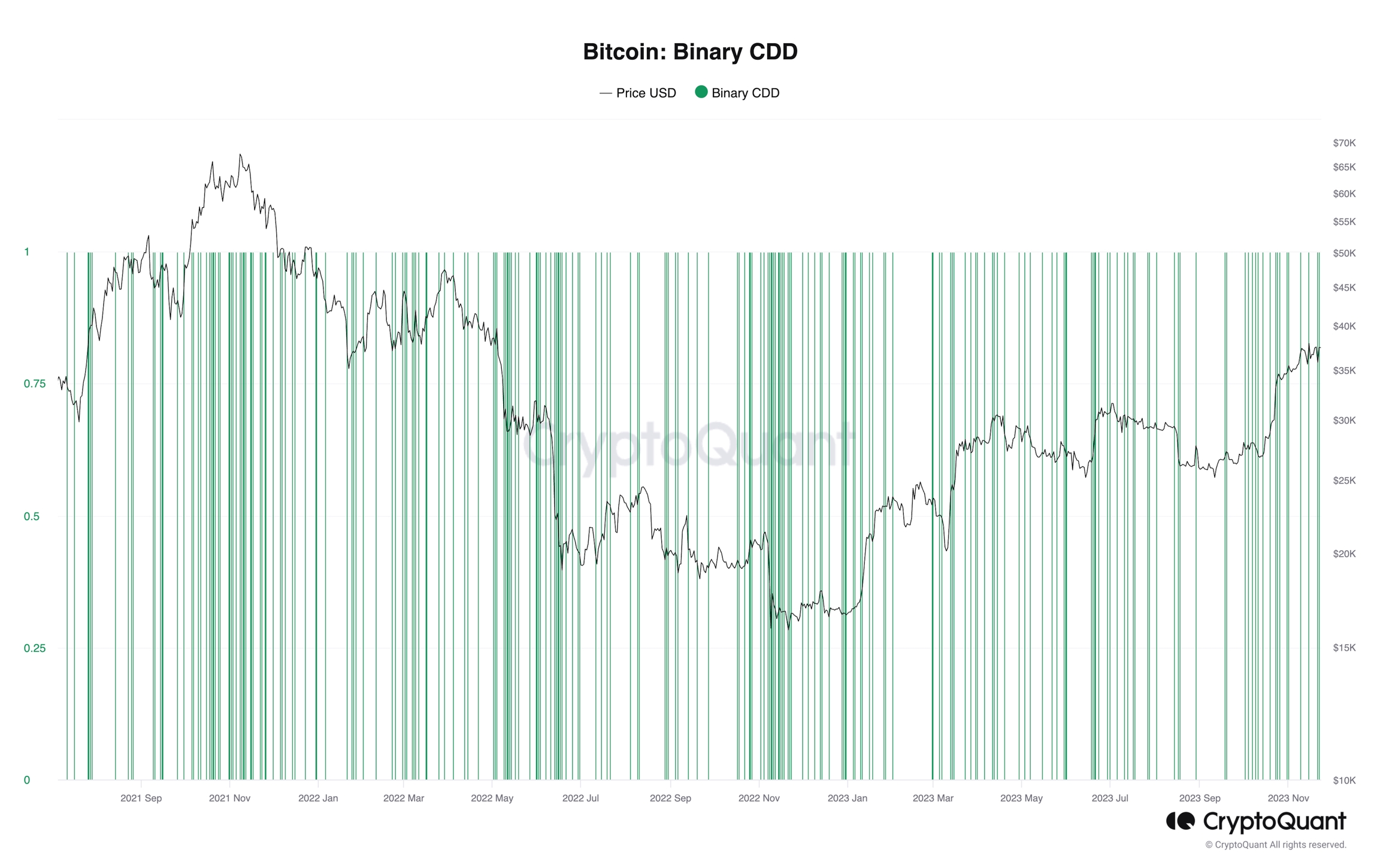

Binary CDD

Signal whether the current Supply-Adjusted CDD is larger than its average or not.

What it measures: Simplifies Coin Days Destroyed into a binary (yes/no) format, adjusted based on the total supply, indicating whether a significant amount of old coins has moved.

How it works: Describes whether Supply-Adjusted CDD on any given day was above or below the historical average, offering insights into the activity of long-held coins in the market.

Why it matters: Provides a binary indication of whether there are notable long-held coins moving, considering the total supply and historical averages, aiding in understanding market trends.

Example Application: Deciphering CDD in Market Trends

Understanding Coin Days Destroyed (CDD) is like having a magnifying glass for crypto market trends. Let's consider its practical application:

Context Matters: Absolute CDD values need context. Lower values under 5 million days might indicate routine daily traffic. Values above 10 million days could signal bullish markets or turning points, impacting bitcoin days destroyed and investor decisions.

Volatility Indicator: Spikes in CDD, especially exceeding 20 million days, are rare and often align with high volatility. It suggests significant movements of older coins, possibly indicating profit realization or losses and affecting CDD values.

Market Confidence: CDD tends to rise in bullish markets and drop during corrections. A return to lower levels after an elevation might suggest increased confidence among long-period holders, favoring coin dormancy and impacting circulating supply.

Smart Money Moves: CDD gives extra weight to long-held coins, often considered the 'smart money.' Tracking large movements in CDD provides valuable insights into market dynamics, especially during critical price action and considerations of circulating supply.

Data Smoothness: To make sense of the raw blockchain data, using moving averages is common. It helps filter out noise, allowing strategic investors to spot trends more clearly, impacting long-term investors' decisions, and CDD values.

Strategic Timing: Critical spikes in CDD often align with key moments in Bitcoin's price action. Large investors, holding bitcoin for extended periods, tend to make significant moves during these crucial times, influencing bitcoin days destroyed and CDD values.

Link to Our Data

Last updated

Was this helpful?