Why Market Driven?

CryptoQuant: Your Gateway to Next-Level Market Data

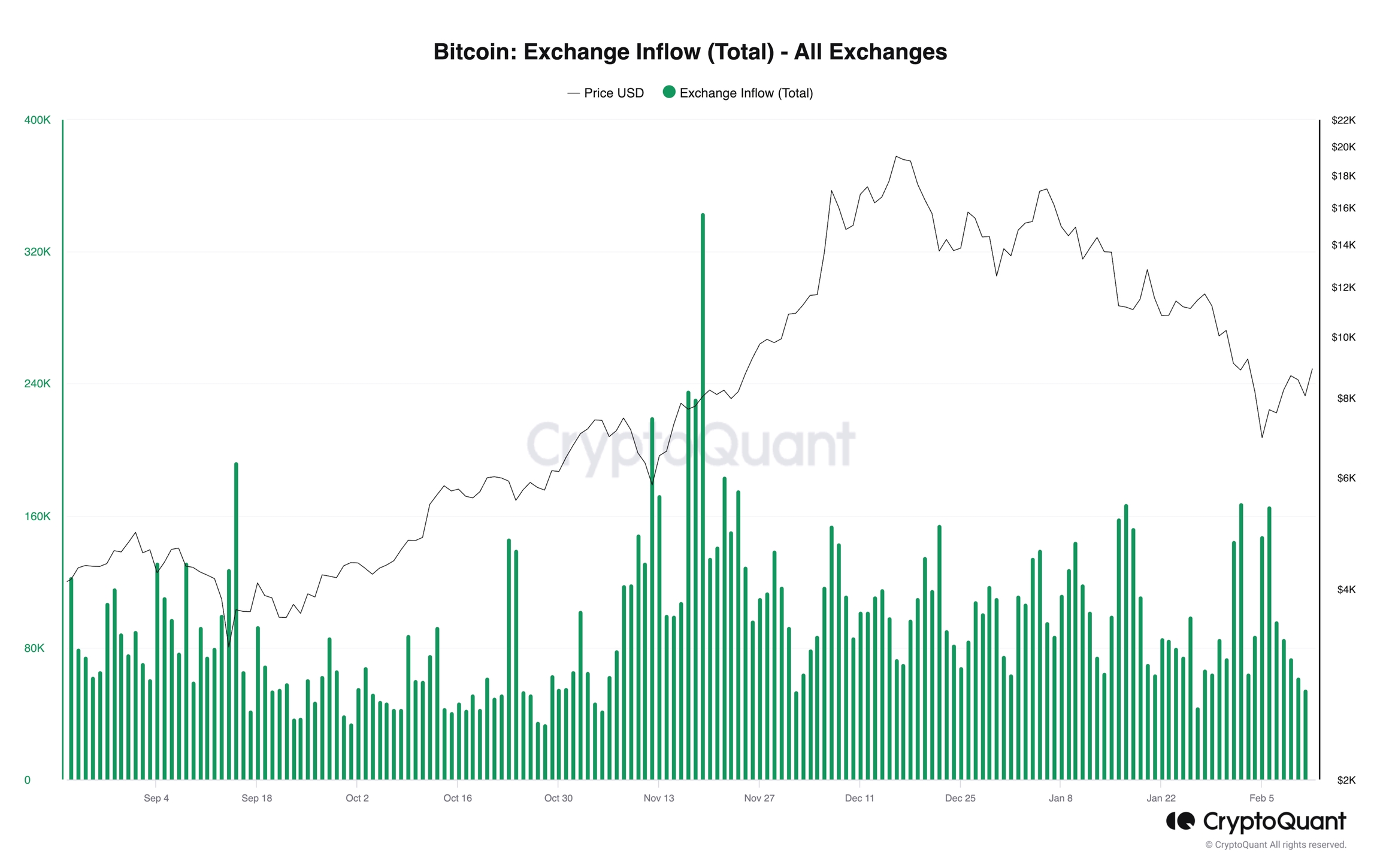

The market is time to time heavily influenced by the short temperament of the market participant. To handle and track market participants' sentiment, data that figures out their movements in the closest and fastest manner possible is required. On-chain data provides valuable macro market insight and information on activities that involve blockchain transactions and even covers exchange flows that analyze blockchain transactions that involve exchanges.

However, it has difficulty in exploring what kind of trades are occurring inside the exchange. Thus, to have a complete and broader view of the market as a whole, data that covers activities inside of exchanges, so-called ‘market data' is needed.

Also, as institutional investors are entering the cryptocurrency market and more retail investors are joining the market, the idea of a futures market that deals with more quantities of funds and serves as risk management is beginning to play a bigger role in the market.

Acknowledging this importance, the company CryptoQuant provides market data and indicators to help investors figure out traders' sentiment.

Why CryptoQuant as a Data Provider?

1) Exclusive market data combined with on-chain

Rather than providing basic market data that could be acquired by freely provided exchanges' account information, CryptoQuant utilizes its on-chain expertise of labeling wallets and on-chain data by combining them with basic market data to draw additional values.

Some indicators or data such as ‘Estimated Leverage Ratio' can't be easily drawn from freely provided market data and only be derived by commercial data providers who have access to accurate on-chain accumulative data.

CryptoQuant provides users with exclusive market data that are combined with on-chain data to help investors go one step further in gaining market insight.

2) Detailed and Precise Market Data

CryptoQuant provides more detailed market data through two methods.

First, CryptoQuant covers a greater number of exchanges than other data providers.

More coverage on exchanges means that CryptoQuant's market data is the closest meaning to the true market data.

Second, CryptoQuant provides some market data by a minute window and volume-weighted average price (VWAP) to produce instant and comprehensive market data.

Market sentiment could be changed in a short period of time especially in the futures market. In order to respond to such changes, data that covers in a minute window is critical to investors to take their profits or protect their wealth. Also, the simple mean of total exchanges' market data has difficulty in accessing the true market and distorts the true means making VWAP data more valuable.

Real-Time Market Monitoring

CryptoQuant's real-time market monitoring capabilities empower market-driven decisions by providing minute-by-minute insights into cryptocurrency markets. This feature ensures that companies and investors can swiftly adapt their strategies to ever-changing market sentiments, minimizing risks and maximizing opportunities. By leveraging cutting-edge technology, CryptoQuant delivers timely data that is crucial for customer success in dynamic industries where real-time responsiveness is key.

Comprehensive Exchange Coverage

In the crypto space, comprehensive exchange coverage is imperative for accurate market research and data-driven decision-making. CryptoQuant stands out by offering an extensive network that spans various exchanges, providing businesses and investors with the resources and a holistic view of markets. This comprehensive coverage enables companies to make informed decisions based on a broader understanding of market movements, catering to the diverse needs of customers engaged in a variety of industries.

Unique Indicators for Informed Decision-Making

CryptoQuant's commitment to providing unique indicators, such as the 'Estimated Leverage Ratio,' sets it apart from competitors in the world of market data providers. These distinctive indicators offer a nuanced perspective that goes beyond the basic market research commonly available. By offering insights not easily accessible elsewhere, CryptoQuant empowers customers to make informed decisions, ensuring their businesses stay ahead in highly competitive markets driven by technology and innovation.

Risk Management in the Cryptocurrency Market

As institutional investors increasingly enter the cryptocurrency market, effective risk management becomes paramount. CryptoQuant's sophisticated data and risk assessment tools serve as a crucial component in companies' risk management strategies. By analyzing market-driven data, businesses can mitigate potential financial losses and safeguard customer accounts, contributing to a secure organization and stable environment within the volatile cryptocurrency markets.

Responding to Market Changes

In the fast-paced cryptocurrency markets, the ability to respond promptly to market changes is vital for business success. CryptoQuant's minute-by-minute data not only provides real-time market insights but also equips customers with the agility needed to adapt strategies in response to sudden shifts in market sentiment. By leveraging this technology, companies can ensure they stay resilient, relevant and responsive to the ever-evolving demands of their customers and industries.

Catering to Institutional Investors and our API

Recognizing the growing involvement of institutional investors, CryptoQuant's API offerings cater to the sophisticated needs of businesses operating in the cryptocurrency space. The API facilitates seamless integration of CryptoQuant's market data into institutional platforms, empowering companies to tailor their services to meet the unique requirements of institutional customers. This strategic approach enhances the company's ability to cater effectively to a diverse customer base and solidifies its position as a preferred market data provider in the rapidly evolving landscape of cryptocurrency and blockchain technologies.

Final Notes

In conclusion, CryptoQuant's powerful combination of real-time insights, extensive exchange coverage, and unique indicators creates a significant difference in the cryptocurrency market. The platform excels in risk management and effortlessly adapts to market changes, providing a valuable resource for businesses and investors.

Our tailored solutions for institutional investors through the API exemplify the platform's commitment to meeting diverse customer needs. As the cryptocurrency landscape evolves, CryptoQuant remains a reliable partner, delivering precise data and cutting-edge technology for informed decision-making. The article explores the depth and calculated performance of CryptoQuant's offerings, disrupting traditional market data approaches. With a mix of innovation, quality and responsiveness, CryptoQuant ranks high in delivering timely, impactful information that sets a new standard in the ever-changing world of digital assets.

Last updated

Was this helpful?