Miner Supply Ratio

Miner Supply Ratio is calculated as the miner reserve divided by the total supply.

Definition

Miner Supply Ratio is calculated as the miner reserve divided by the total supply. The metric measures the ratio of tokens reserved in miner wallets relative to the total supply of the token.

The Miner's Role in the Ecosystem

To gain a comprehensive understanding of the Miner Supply Ratio, it is imperative to delve into the intricacies of the mining ecosystem. Miners serve as the cornerstone in validating blockchain transactions, ensuring security, and generating new tokens in the process. When miners are rewarded for their efforts, these tokens augment their reserves, invariably influencing the Miner Supply Ratio.

The miner's perspective holds substantial significance, transcending the realms of solving intricate mathematical puzzles. It encapsulates the strategic choices regarding when to vend, retain, or accumulate the cryptocurrency they have earned. These determinations exert a direct impact on the Miner Supply Ratio and, in turn, the broader cryptocurrency market.

Historical Trends and Price Implications

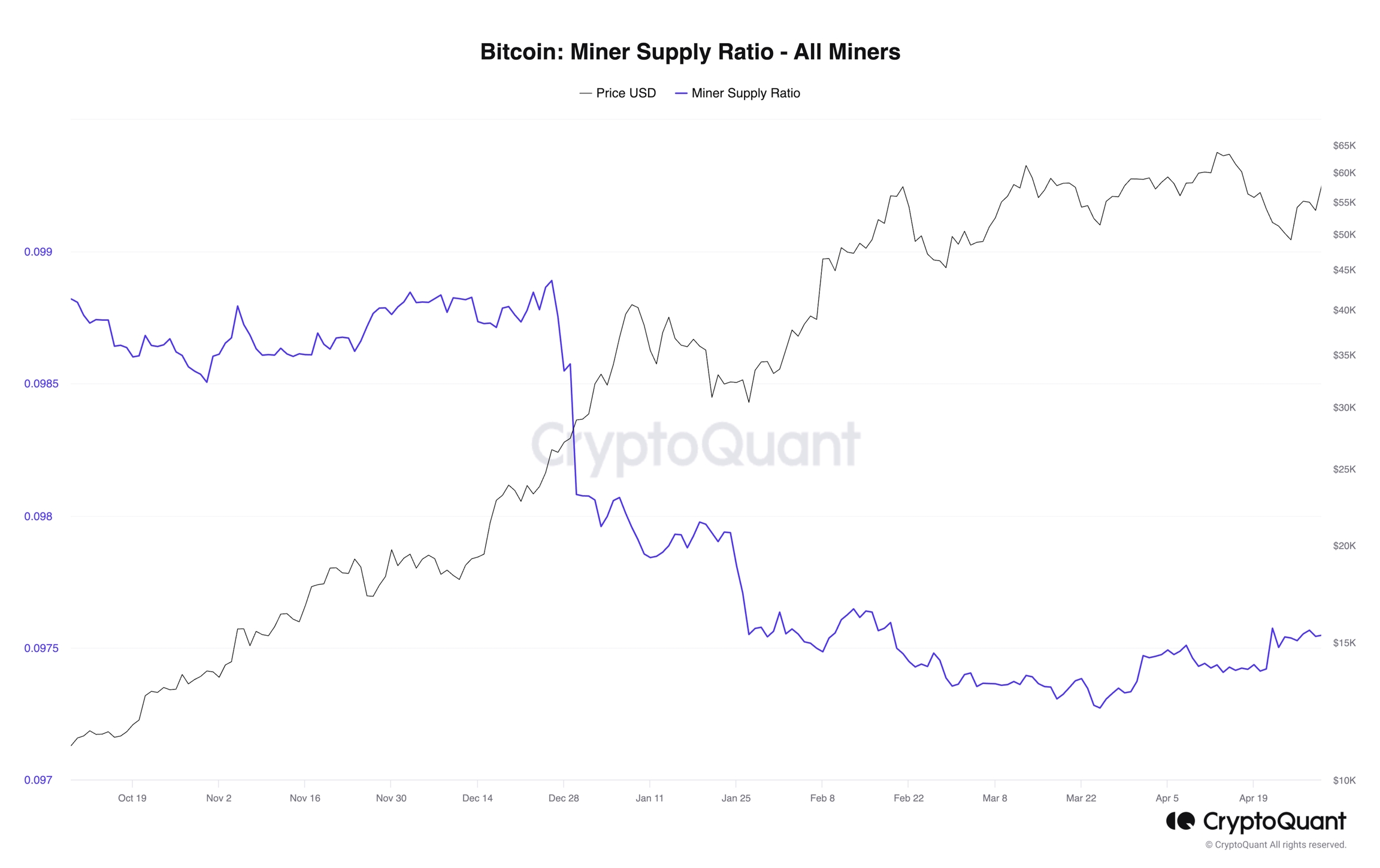

Scrutinizing historical trends in the Miner Supply Ratio can be an enlightening experience. It can unveil patterns and correlations between fluctuations in the ratio and corresponding movements in cryptocurrency prices. For example, a conspicuous escalation in miner reserves often foreshadows an upswing in the cryptocurrency's price as miners anticipate and support its future appreciation.

Conversely, a decline in the Miner Supply Ratio may serve as a bearish indicator. Miners may commence the liquidation of their reserves, triggering selling pressure and resultant price corrections. A profound comprehension of these historical price implications serves as an invaluable resource for traders and investors alike.

Comparative Analysis Across Cryptocurrencies

Conducting a comparative evaluation of Miner Supply Ratios across various cryptocurrencies can yield fascinating insights. Notably, Bitcoin may exhibit a considerably different Miner Supply Ratio in comparison to an alternative cryptocurrency. These disparities are shaped by diverse factors, including block rewards, total supply, and network adoption.

Delving into these distinctions enables us to comprehend why specific cryptocurrencies are more susceptible to price volatility or stability than others. It also offers insights into the strategies of miners who endeavor to accumulate the cryptocurrencies they mine.

Wider Market Dynamics

The Miner Supply Ratio transcends the realms of a niche metric to exert a pivotal role in shaping the broader market dynamics. It imparts influence over liquidity, subsequently impacting price stability. When the Miner Supply Ratio trends upward, liquidity levels often surge, simplifying the process of market entry and exit for traders.

Conversely, a declining Miner Supply Ratio can lead to diminished liquidity levels, typically coinciding with intensified price volatility. Traders vigilantly monitor these trends, recognizing that they frequently present significant trading opportunities.

Real-World Implications of Miner Supply Ratio

In the dynamic world of cryptocurrency, metrics like Miner Supply Ratio transcend theory and exhibit substantial real-world and business implications. Here, we delve into some practical examples where this metric plays a pivotal role in understanding market dynamics and making informed decisions:

Bitcoin's Halving Events

Bitcoin's periodic halving events, which reduce the rate at which new bitcoins are issued, have a profound impact on its Miner Supply Ratio. As these events unfold, miners typically experience a substantial reduction in the value of their rewards. This leads to a decrease in their reserve of newly minted bitcoins, causing a shift in the Miner Supply Ratio. Observing this shift allows market participants to anticipate how miners may adjust their strategies, potentially influencing Bitcoin's price direction.

Bitcoin's Accumulation Phases

Historically, Bitcoin has experienced phases of accumulation by long-term investors, often coinciding with a declining Miner Supply Ratio. These accumulation phases suggest that miners and long-term investors are holding onto their BTC reserves, anticipating future price appreciation. As traders and investors identify these periods of reduced Miner Supply Ratios, they may consider them opportune times to accumulate Bitcoin before potential bullish trends.

Considerations for Investors

For investors within the cryptocurrency sphere, a comprehensive grasp of the Miner Supply Ratio is not only advantageous but imperative. This metric facilitates the identification of potential market trends, ranging from imminent price rallies to corrections. Additionally, it offers insights into the long-term health of a cryptocurrency by discerning whether miners are accumulating or divesting their holdings, thereby allowing investors to make well-informed decisions.

Last updated

Was this helpful?