Miner Outflow

The outflow of Bitcoin from mining pool wallets. We define mining pool wallets in our metrics as all participants in the mining pool including individual miners.

Definition

Bitcoin miner outflows from mining pool wallets. We define mining pool wallets in our metrics as all participants in the mining pool including individual miners.

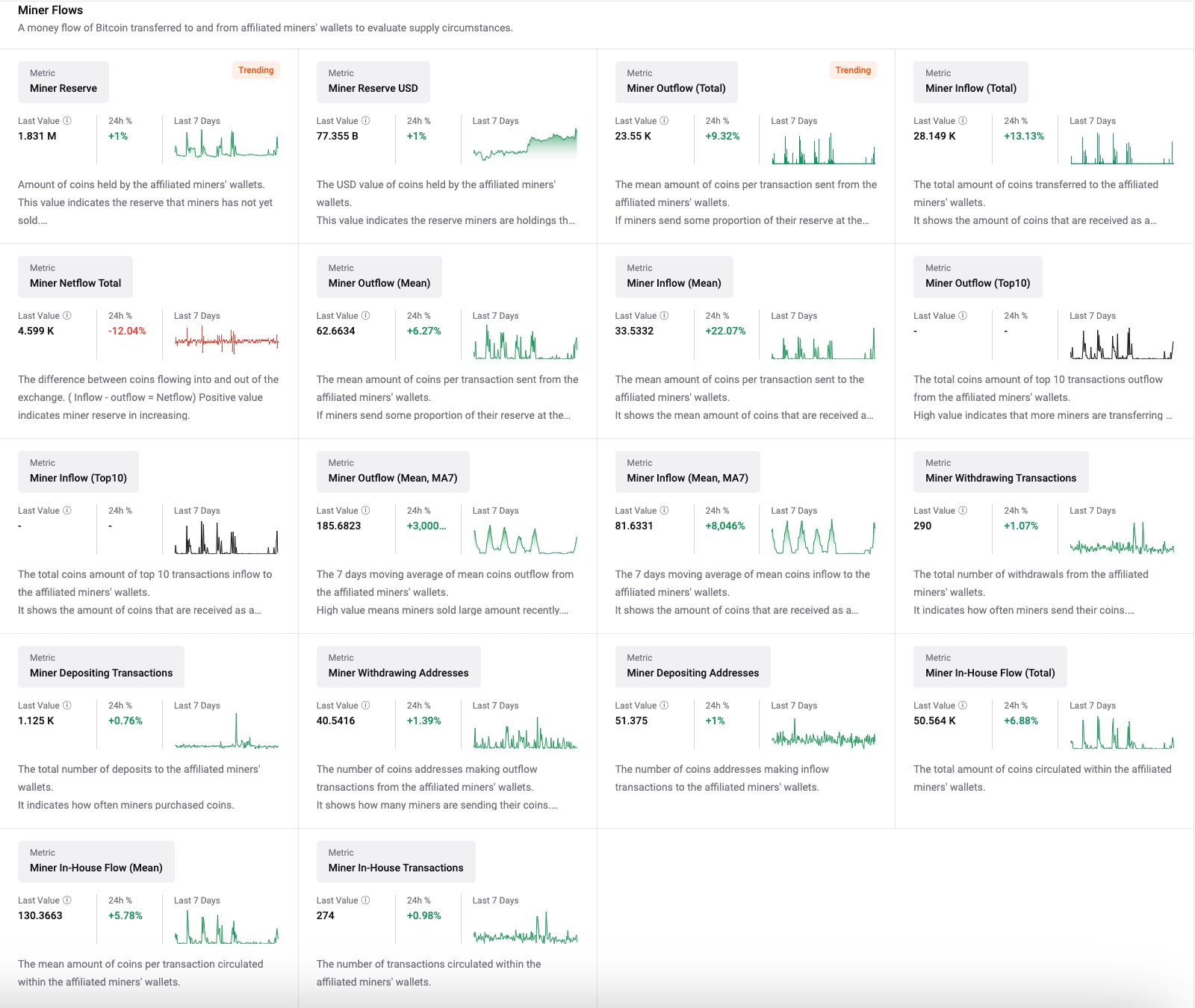

Metrics

Description

Outflow Total

The total amount of BTC transferred from the miner.

Outflow Mean

The mean amount of BTC per transaction sent from the miner.

Outflow Top10

The total BTC amount of the top 10 transactions outflow from the miner

Outflow Mean(MA7)

The 7 days moving average of mean BTC outflow from the miner.

The mean value is the Outflow Total divided by the Transactions Count Outflow.

The outflow of BTC from mining pool wallets.

We define mining pool wallets in our metrics as all participants in the mining pool including individual miners. Miner Outflow includes Miner sending their coins to the exchanges as well as internal transfers or to other entities.

Interpretation

By value itself

High: A lot of miners' coins are exposed to selling, (Bearish) Bitcoin's price could go down.

Low: only a few of miners' coins are exposed to selling, (Bullish) Bitcoin's price could go up.

By examining trend

Increased Outflows: Miners' selling power is increasing - Bearish

Decreased Outflows: Miners' selling power is decreasing - Bullish

About Bitcoin Miner Outflow

As the glossary says, bitcoin miners send their coins outside for various reasons.

Understanding Bitcoin Miner Outflows

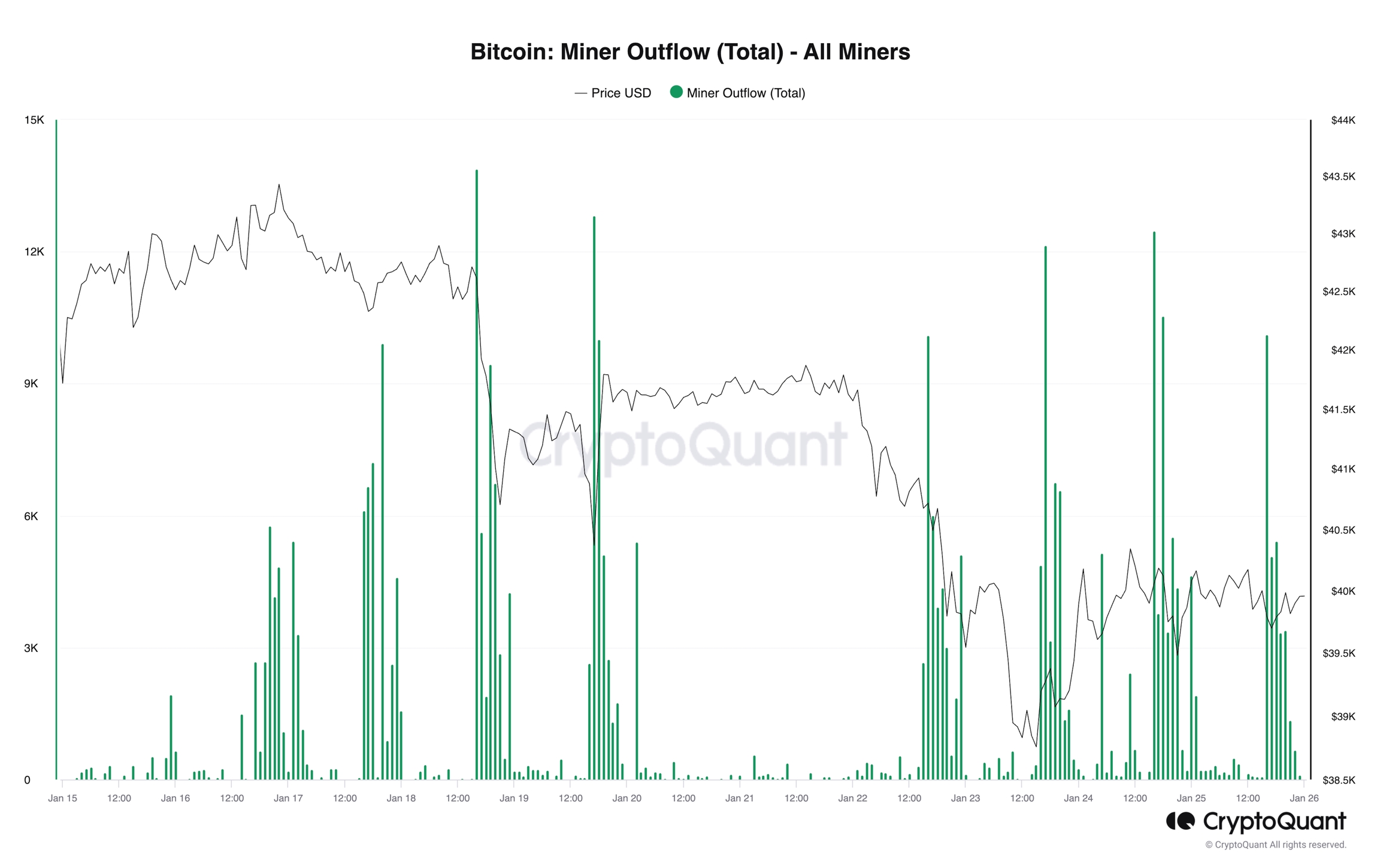

Bitcoin miners play a pivotal role in the cryptocurrency ecosystem, but their activities often influence prices and market dynamics in ways that warrant closer examination. One such aspect is the movement of bitcoins from miners' wallets to external addresses, commonly known as miners' outflow.

Overview of Miner Outflows

Miners regularly transfer their coins to external addresses for various reasons, reflecting the dynamic nature of their operations. These outflows can provide valuable insights into market sentiment and crypto price trends.

Key Scenarios:

Moving to Exchanges for Possible Selling (Bearish Sign) When miners transfer their coins to cryptocurrency exchanges, it is typically when indicating an intent to sell. This could be driven by the need to cover operational costs or to capitalize on price fluctuations. Such actions are often interpreted as bearish signals, as increased selling pressure may exert downward pressure on prices.

Internal Wallet Movements (Neutral Sign) Conversely, transfers between miners' internal wallets, excluding trading activities, carry a more neutral connotation. These movements may be conducted for reasons unrelated to market speculation, such as security enhancements or operational optimizations. While they do not directly impact market sentiment, they underscore the complexities of monitoring miners' activities.

Strategic Hodling by Miners (Bullish Sign)

When miners opt to hold onto newly mined bitcoins instead of rushing to sell them, it's a bullish sign. This strategic decision reflects confidence in Bitcoin's long-term value and potential for growth. By reducing immediate selling pressure, miners contribute to a supply shortage, which can drive prices upward. Essentially, miners betting on Bitcoin's future success is a positive indicator for the market that prices may rise.

Implications and Analysis

Analyzing miners' outflows over the past few days can provide valuable insights into market dynamics. Large-scale movements, involving tens of thousands of bitcoins, may indicate shifts in the bitcoin miner outflow behavior that could influence less or more liquidity in the market and/or price stability.

Considering the Halving Effect

The halving event, which reduces the rate at which new blocks of bitcoins are generated, has historically influenced miner outflows behavior. As rewards diminish, miners may adjust their strategies to optimize profitability, potentially impacting the frequency and magnitude of outflows.

Final Words

In conclusion, monitoring Bitcoin miners' outflows offers a nuanced perspective on market dynamics, reflecting the interplay between mining operations, market sentiment, and price trends. By using miner outflows and understanding the motivations behind these movements and their potential implications, market participants can make more informed decisions in the ever-evolving crypto landscape.

Links to Our Data

Last updated

Was this helpful?